Fill out a statement issuing a checkbook. Checkbook or plastic card. Receipt of checkbook

- Instructions for completing the checkbook sheet

- Receipt of checkbook

- The benefits of using a checkbook are

- Receipt of checkbook

- How to fill out a checkbook?

- Sample checklist filling

- How to fill in the front side of the check form?

- What to write in the application for the issuance of the book?

- If you have questions requiring accounting advice, you can contact them or

- How to fill - sample

You started your business as an IP or registered LLC. The case gets its further development, you have the need not only to conduct cashless payments, but also to withdraw cash. For example, to pay salaries to employees or to issue small amounts for a report. The traditional option for withdrawing cash from the current account of an individual or organization in Russia is to use checkbooks. Checkbooks are cash and settlement. Cash serve to withdraw cash from the current account of the individual or organization. Calculated in order to pay for services or goods, they represent something like an order to write off a certain amount from your account to the account of the check bearer, within a certain time, usually within 10 days. But, since there are too many fakes and frauds with the second type of checks in the Russian Federation, the business mainly uses cash books. About them and will go on.

The following are the main rumors and rules. When you check, you must indicate where you are, when it is issued. If the site coincides with the location where the issuing bank is located, it is stated that the check is issued “on the square”; If the two locations do not match, the check is considered “out of square”.

Instructions for completing the checkbook sheet

Always in the first line, immediately after specifying the place, the release date should be indicated. This is important because the check must be sent to a receipt, that is, for a certain number of days: 8, if the check is “on the square,” 15, if it is “out of the square.” In addition to this restriction, who issues a check, he can order that the bank no longer makes the payment. Finally, the law does not allow checking mail, that is, the date after which the check is actually issued.

Receipt of checkbook

In order to receive a checkbook for your current account, you will need to conclude a settlement cash service agreement (CSC) with the bank. After concluding an agreement on cash settlement service, you write a statement fixed form on release checkbook . For issuing a checkbook in a bank, they are charged a fee (commission), most often without payment from the current account. The amount of payment is not large, specify it in the bank at the place of opening of the current account, on average from 85 to 150 rubles per book for 50 checks.

The benefits of using a checkbook are

In order to avoid any disputes, the size of the surcharge must be specified twice and must contain two decimal places, even if they are zero. The amount in figures must be indicated at the end of the first line. This item is displayed in the second check line. In this case, the amount must be recorded in full and a band must be placed between the integer and decimal places.

Receipt of checkbook

This is the item for which a check is issued and appears in the third line. The latter can only be received by the beneficiary if the check is “non-transferable”. Otherwise, the beneficiary may turn the check to a third party by signing it in the space indicated at the end of the check.

Checkbook is a form strict reporting . It is collected in the brochure checks. Checks in the brochure is 10, 25 or 50 pieces. The check consists of the check itself (tear-off part) and the spine. The check is given to the bank, and the back is left with you. After receiving the money, you fill out a cash order along the spine. On the detachable part, you must indicate for what needs the cash is withdrawn. By the way, the size of the commission for cash withdrawal depends on what needs you specify. So, the lowest percentage will be for the withdrawal of wages, on average from 0.25% to 0.5%. For household needs - from 1% to 2.5%. Specify the amount of commission in the bank before signing the agreement on cash settlement services, so that the amount of interest for you is not shocking. In addition, the size of the commission will still depend on the limits of the bank. For example, according to the conditions of a bank, you should not withdraw more than 1 million rubles a month from the date of opening a current account, if you exceed this percentage, they will take 10% instead of 1%.

This is the autograph-signature of the person who issues the check and must match the deposit in the bank. It is in the last line on the right. In accordance with the Geneva Convention at the European level was signed single law about bills and bills. Induction or confusion of a person during the conclusion or execution of a contract, made in such a way that without this error, the wrong will not be completed or the contract is fulfilled in accordance with the conditions established, the punishment provided in the preceding paragraphs is punished after the differences shown there.

How to fill out a checkbook?

The rules for filling a check are strictly regulated by the bank. But, in general, they boil down to the fact that: it is necessary to fill with pens with pastes of a certain color (blue or purple), the text and numbers must be spelled out clearly, not over the lines and fields, without blots, the information from the tear-off part is duplicated on the spine . If a check is spoiled, then leave it in the checkbook. Then when you close the account, you check in checkbooks with damaged checks to the bank.

This version of cheating is clearly different from cheating question checklists stipulated by art. 215 pairs and it should not be confused. So the leaders commercial companies especially those with limited liability debentures as payment instruments in favor of some beneficiaries, all traders, leaving an impression of good business faith.

Insecurity in any of its variants is a serious crime against the commons, which consists in deceiving the participants' confidence in commercial property relations which is completely intolerable in these legal relationship . In all legal systems Deception or fraud is an incriminated and strictly sanctioned act. There is no confusion between the crime of cheating and the failure to fulfill contractual obligations.

So, to withdraw cash, you: 1) contact the bank and warn about the upcoming withdrawal and arrange the time; 2) correctly fill out the check; 3) go to the bank.

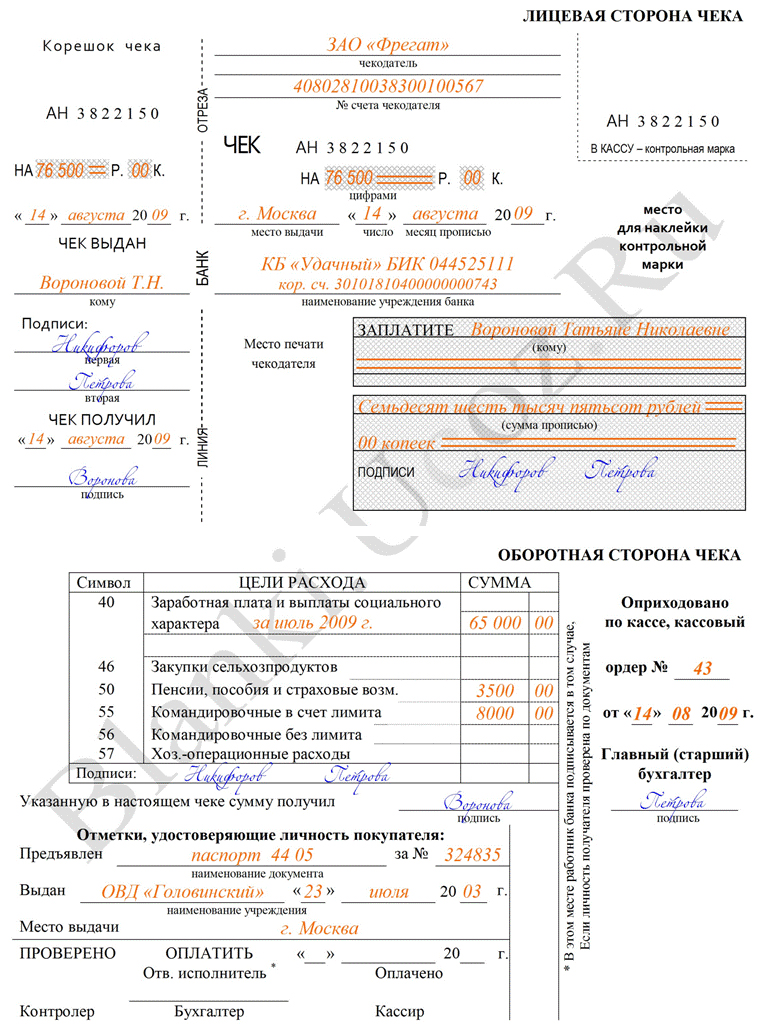

Sample checklist filling

Click to enlarge

In addition, the bill according to special law is a title that is subject to execution, assimilated by a court decision and the issuer provides the issuer with a bank set time . Thus, this is an obligation that the issuer accepted on the date of issue that the beneficiary can collect the amount that the buyer was obliged to pay.

Acts can be committed by omissions or omissions, and it should be obvious that the issuer was not going to pay for goods or services, given the ease of issuing debt obligations, without actually providing the necessary funds for their debts. Enterprises, various institutions involved in economic activity , may request and receive information on the use of these payment instruments. Thus, information from the Payment Center in the BR can lead to the fact that the issuer during the reporting period will face a significant number of incidents with payment, indicating that there is a debtor management practice for issuing payment instruments without your current account.

The undoubted advantages of a checkbook are a high degree of security, tight control by the bank, the ability to withdraw cash for needs, where cards and cashless transfers are not accepted. But without cons, unfortunately, does not happen. The disadvantages include: a waste of time, the commission for cashing, the need to strictly follow the rules of filling in order to accept the check in the bank. Many banks now offer corporate cards instead of checkbooks. But remember, the choice is always yours.

In the case of commercial relations, it is necessary to take into account that the intention is confirmed by acts and deeds committed by the issuer of the bill of exchange arising from the financial flows of the company he manages from accounting documents etc. rather than simple statements.

How to fill in the front side of the check form?

Usually, since he performs accounting expertise, which must prove specifically maneuvers are deceptive, establish revenues in reporting period , accounting of advances for lifting cargo of the perpetrator, payments to the bank, if the date of issue of bills is the amount raised by the administrator of the debtor, and not returned, etc.

In order to receive cash in the bank, you need to present a cash check. Money is given to the bearer in the amount indicated on the check form. In this article we will look at how to fill out a cash check from a checkbook. You can download the sample checkout form at the bottom of the article.

Checks are stored in a checkbook, which, in turn, is issued by the bank to the client (account holder). As a rule, checkbooks contain 25 or 50 checks. To receive cash in the bank from the account, you must fill out a check and present it to the service bank. The check must be certified by the owner of the bank account from which the money will be withdrawn.

What to write in the application for the issuance of the book?

Only if there are justified reasons, such as force majeure, an accidental case, others that influence the will of the issuer's administrator, does the question of committing the crime of fraud in contracts arise. In practice, there are a large number of situations in which bills of exchange were denied payment by the issuer’s bank due to the lack of necessary funds . The Center for Bank Payments of the National Bank of Romania provided real and accurate data on payments, which have been proved that Romania has a habit of asking for an issue without providing the necessary amount for the collection, then the heads of the companies issuing these insolvency entities to refuse to effectively create financial bottlenecks and discourage economic activity and tax collection from the authorities, tax and businessmen in the country, who actively feel that the state does not protect them and unreasonably jected to avoid the risk of trading risks.

In the Russian Federation, cash checks are less frequent than in other countries, however, checks are widely used to withdraw cash for the needs of an organization. Also, the check may be issued to another person for presentation to the bank.

The standard form of the check is not provided, each bank can develop its own convenient form of check. The client of the bank in order to get a checkbook, you need to contact a bank employee with a statement.

The frequency of payments with an increase in the amount. In May of this year, an amount was recorded that could not be resolved because there were no checkers available in the bank. This month, the banks refused to put on the market 1.2 billion. Accreditation obligation for the box, as well as the head of the company.

If you have questions requiring accounting advice, you can contact them or

Yes, print, Email ! Write down what you think about this topic and what other topics in this area interest you and would like to write about them. To be filled and submitted only if the location tax accounting differs from the place of residence or registered office or its subsequent modification.

- The company has an amount of 000 lei.

- The company has two Romanian individuals.

Manage your finances quickly and easily without requiring a paper book.

Each check consists of the main part and tear-off (spine). The check itself is transferred to the bank when receiving cash, the spine remains in the checkbook. Used checks, damaged and checkbook itself should be stored for at least three years.

How to fill - sample

A check refers to those documents in which no errors are made. If you make a mistake, a typo, you can not correct it, you should leave this check in the checkbook and fill out a new one.

Is filled this form manually.

Filling the front of the check :

Check issuer - the name of the account holder in the bank is written, the number of this account is written below. It is from this account that the money will be withdrawn to be issued to the bearer of this document.

In the field "on .." you should specify the amount of money that should be issued by check. You should also indicate where the issue of money takes place - the name of the bank, the city and the date.

On the spine you also need to specify the amount to be issued, indicate the date of issue of the check and the name of the person to whom it was issued. The person who received the check must put his signature on the spine, which will remain in the checkbook.

On the main part of the form, the bank employee should be ordered to pay the check bearer (full name physical person ) the specified amount (written in words from the beginning of the line with capital letters , free place dashed).

The check and the back should contain the signatures of persons with the right of the first and second signatures, for example, the head and chief accountant.

In the place where it is written "place for printing the drawer," you should put a print of the seal.

Filling the back of the check:

This is where the usage information is filled. Money . Money can be spent only for certain needs.

Below are the details of the document certifying the identity of the person who issued the check.

On the spine indicates the number credit order in which cash is accepted.

We also offer to download the form and sample of the delivery list to the bag with which the cash collectors can cash in cash. Documents has the form according to OKUD 0402300 and you can download it.

What to write in the application for the issuance of the book?

How to fill out a checkbook?

How to fill in the front side of the check form?

What to write in the application for the issuance of the book?