Accounting for exchange differences in the configuration "Management of a small company for Ukraine"

- Content

- What is exchange rate difference?

- At what point in time is revaluation carried out?

- What assets and liabilities are revalued in the configuration?

- How are exchange differences recorded?

- How are exchange rate differences calculated?

- Example of accounting for exchange rate differences in the configuration

1C: Enterprise 8.2 /

Management of a small company for Ukraine /

General

Table of contents

Content

What is exchange rate difference?

At what point in time is revaluation carried out?

What assets and liabilities are revalued in the configuration?

How are exchange differences recorded?

How are exchange rate differences calculated?

Example of accounting for exchange rate differences in the configuration

Content

- What is exchange rate difference?

- At what point in time is carried out revaluation ?

- What assets and liabilities are revalued in the configuration?

- How are exchange differences recorded?

- How are exchange rate differences calculated?

- An example of accounting for exchange rate differences in the configuration.

What is exchange rate difference?

In configuration " Management of a small company for Ukraine »Accounting currency user can choose independently, unlike for example the configuration "1C: Accounting for Ukraine ”, Where the currency of accounting can only be national, such as Ukrainian hryvnia.

This circumstance introduces a slight clarification in the standard definition of exchange rate differences. So, the exchange rate difference in the “Small company management” configuration is understood as the difference between the valuation of an asset or liability in the currency of management accounting, the value of which is expressed in another currency, on the date of fulfillment of payment obligations or the closing date of this reporting period, and the valuation of the same asset or liabilities in the currency of management accounting as of the date it was accepted for accounting in the reporting period or the closing date of the previous reporting period.

In other words, transactions in a currency other than the accounting currency are translated into the accounting currency at the exchange rate at the transaction date. In most cases, recounting is performed not only on the date of the transaction, but also on the date closing month . If the exchange rate has changed compared to the previous revaluation date, an exchange difference arises. A change in the valuation in the accounting currency results in income or expense appearing in the system.

At what point in time is revaluation carried out?

Some assets and liabilities are remeasured both at the date of the transaction and at the closing date of the reporting period, while others only at the date of the transaction.

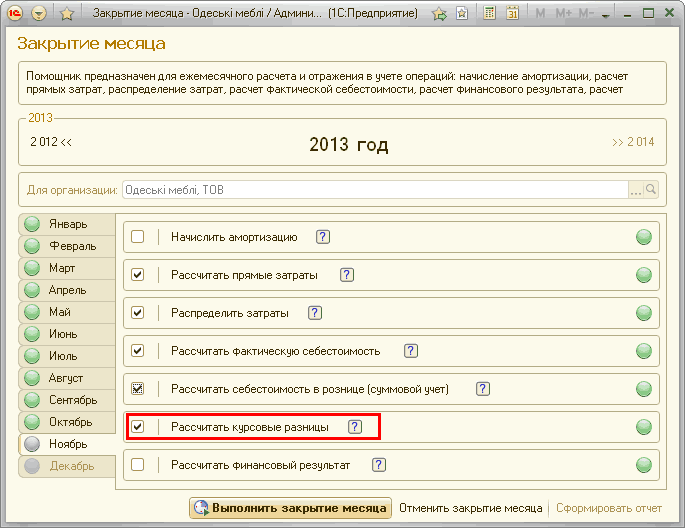

The calculation of exchange differences at the time of the transaction is automatic, and to calculate exchange differences when closing the reporting period, you must set the corresponding flag in the month closing assistant.

What assets and liabilities are revalued in the configuration?

On the date of the transaction and the closing date of the reporting period, the following is reassessed:

- Cash;

- Cash in box office KKM;

- Settlements with staff;

- Settlements with accountants;

- Settlements with customers (excluding advances received);

- Settlements with suppliers (excluding advances paid).

Revaluation of the total accounting in retail is carried out only on the date of the transaction.

Advances, prepayments and deposits of buyers and suppliers are accepted for accounting in the currency of management accounting at the exchange rate at the date of capitalization and are not subsequently remeasured.

How are exchange differences recorded?

Exchange differences are accounted for in the configuration as other income or expenses and are reflected in the financial result.

How are exchange rate differences calculated?

The exchange rate difference arising at the time the transaction is recorded is calculated using the following formula:

Crop = Summavr * (Ostatokvu / Ostatokvr - Cursvr * Multiplicity / / Cursvu * Multiplicity)

- Crop - exchange rate difference of the operation,

- Summavr - the amount of the transaction in the settlement currency,

- To the balance - the amount of the balance of payments in the accounting currency,

- Residue - the amount of the balance of payments in the currency of settlements,

- Coursvr - current exchange rate,

- Multiplicity - current multiplicity of settlement currency,

- Kursvu - the current exchange rate,

- Multiplicity - the current multiplicity of the accounting currency.

At the end of the period, the exchange rate difference is calculated using the following formula:

Kros = Ostatokvr * Coursevr * Multiplicity / / Kursvu * Multiplicity) - Ostatkov

- Kros - exchange rate difference balance

- To the balance - the amount of the balance of payments in the accounting currency,

- Residue - the amount of the balance of payments in the currency of settlements,

- Coursvr - current exchange rate,

- Multiplicity - current multiplicity of settlement currency,

- Kursvu - the current exchange rate,

- Multiplicity - the current multiplicity of the accounting currency.

Example of accounting for exchange rate differences in the configuration

In the configuration, the Ukrainian hryvnia is set as the accounting currency. On the date of June 10, an advance payment from the buyer in the amount of 150 euros was received at the cash desk of the organization. The euro exchange rate against the hryvnia on June 10 was 10 hryvnias, respectively, in addition to recording in settlement currency with the counterparty in the configuration, the amount in the accounting currency 150 * 10 = 1500 hryvnias will be fixed.

On the date of June 20, the buyer was realized and offset the advance payment in the amount of 100 euros. The euro exchange rate on June 20 was 11 hryvnias, respectively, the amount of hryvnia cover on sale is 1100 hryvnias. The exchange rate difference is calculated from the amount of the operation and will be 100 * (1500/150 –11 * 1 / (1 * 1)) = - 100 hryvnias. A minus sign means that the exchange rate difference is negative and should be allocated to other expenses. Those. in this case, the organization incurred a loss in the accounting currency due to an increase in the euro, in other words, the organization shipped goods for 1,100 hryvnias in the accounting currency, and received only 1,000 hryvnias for them.

At the end of the month, the organization received an advance payment of 150 euros from the buyer at the box office. The euro at the end of the month amounted to 10.5 hryvnia. The exchange rate difference for the cash balance at the cash desk will be 150 * 10.5 * 1 / (1 * 1) –1500 = 75 hryvnias. In this case, the amount of the exchange rate difference is attributable to other income, i.e. the organization received income in the accounting currency due to the appreciation of the euro.

Other materials on the topic:

Exchange Rates. , course , management of a small company for Ukraine , closing , exchange difference , from the buyer , assets. , calculated , currencies , obligations , course , revaluation , cash , assets , prepaid expense , calculations , balance , income , example , the amount , organization , period , operations , configurations , accounting

Materials from the section: 1C: Enterprise 8.2 / Management of a small company for Ukraine / General

Other materials on the topic:

Revaluation of fixed assets

System-wide mechanisms and principles

Sources of data for budgeting calculations

Calculation of exchange rate differences in mutual settlements with customers

Calculation of exchange rate differences at the average rate for postpayments to the supplier

We find: 1s unf exchange rate differences when calculating the margin , as in 1s the exchange rate difference is calculated , exchange differences in 1s 8 2, exchange differences in 1s are recalculated, exchange differences, 1s is the difference in rates, how the difference in exchange rates is reflected in unf, calculation of exchange differences in management trade 11 4, exchange differences in trade management 11 4, accounting for exchange rates in management accounting

At what point in time is revaluation carried out?

At what point in time is revaluation carried out?What assets and liabilities are revalued in the configuration?

How are exchange differences recorded?

How are exchange rate differences calculated?

At what point in time is revaluation carried out?

What assets and liabilities are revalued in the configuration?

How are exchange differences recorded?

How are exchange rate differences calculated?

What assets and liabilities are revalued in the configuration?

How are exchange differences recorded?